Page 130 - HRC_Annual_Report_2023

P. 130

128 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

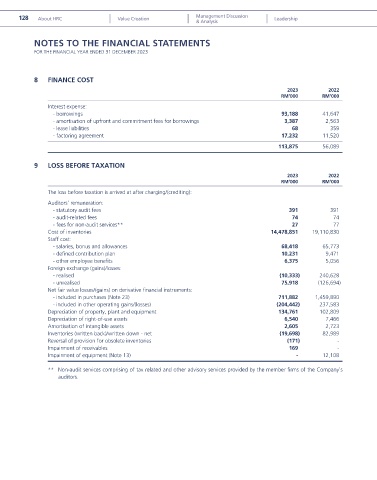

8 FINANCE COST

2023 2022

RM’000 RM’000

Interest expense:

- borrowings 93,188 41,647

- amortisation of upfront and commitment fees for borrowings 3,387 2,563

- lease liabilities 68 359

- factoring agreement 17,232 11,520

113,875 56,089

9 LOSS BEFORE TAXATION

2023 2022

RM’000 RM’000

The loss before taxation is arrived at after charging/(crediting):

Auditors’ remuneration:

- statutory audit fees 391 391

- audit-related fees 74 74

- fees for non-audit services** 27 77

Cost of inventories 14,478,851 19,110,830

Staff cost:

- salaries, bonus and allowances 68,418 65,773

- defined contribution plan 10,231 9,471

- other employee benefits 6,375 5,056

Foreign exchange (gains)/losses:

- realised (10,333) 240,628

- unrealised 75,918 (126,694)

Net fair value losses/(gains) on derivative financial instruments:

- included in purchases (Note 23) 711,882 1,459,890

- included in other operating gains/(losses) (204,442) 237,583

Depreciation of property, plant and equipment 134,761 102,809

Depreciation of right-of-use assets 6,540 7,466

Amortisation of intangible assets 2,605 2,723

Inventories (written back)/written down - net (19,698) 82,989

Reversal of provision for obsolete inventories (171) -

Impairment of receivables 169 -

Impairment of equipment (Note 13) - 12,108

** Non-audit services comprising of tax related and other advisory services provided by the member firms of the Company’s

auditors.