Page 131 - HRC_Annual_Report_2023

P. 131

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 129

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

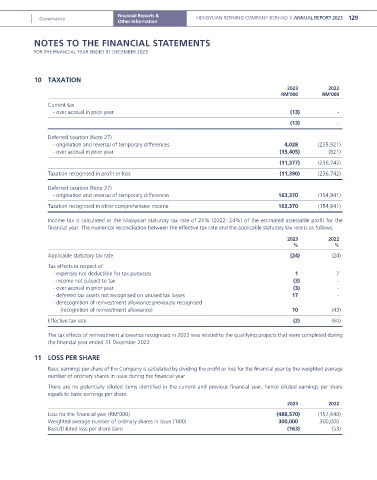

10 TAXATION

2023 2022

RM’000 RM’000

Current tax

- over accrual in prior year (13) -

(13) -

Deferred taxation (Note 27)

- origination and reversal of temporary differences 4,028 (235,921)

- over accrual in prior year (15,405) (821)

(11,377) (236,742)

Taxation recognised in profit or loss (11,390) (236,742)

Deferred taxation (Note 27)

- origination and reversal of temporary differences 163,370 (154,841)

Taxation recognised in other comprehensive income 163,370 (154,841)

Income tax is calculated at the Malaysian statutory tax rate of 24% (2022: 24%) of the estimated assessable profit for the

financial year. The numerical reconciliation between the effective tax rate and the applicable statutory tax rate is as follows:

2023 2022

% %

Applicable statutory tax rate (24) (24)

Tax effects in respect of:

- expenses not deductible for tax purposes 1 7

- income not subject to tax (3) -

- over accrual in prior year (3) -

- deferred tax assets not recognised on unused tax losses 17 -

- derecognition of reinvestment allowance previously recognised

(recognition of reinvestment allowance) 10 (43)

Effective tax rate (2) (60)

The tax effects of reinvestment allowance recognised in 2022 was related to the qualifying projects that were completed during

the financial year ended 31 December 2022.

11 LOSS PER SHARE

Basic earnings per share of the Company is calculated by dividing the profit or loss for the financial year by the weighted average

number of ordinary shares in issue during the financial year.

There are no potentially diluted items identified in the current and previous financial year, hence diluted earnings per share

equals to basic earnings per share.

2023 2022

Loss for the financial year (RM’000) (488,570) (157,640)

Weighted average number of ordinary shares in issue (’000) 300,000 300,000

Basic/Diluted loss per share (sen) (163) (53)