Page 132 - HRC_Annual_Report_2023

P. 132

130 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

12 DIRECTORS’ REMUNERATION

2023 2022

RM’000 RM’000

Fees 1,900 1,956

Allowances 22 25

1,922 1,981

Indemnity insurance for Directors and Officers of the Company during the financial year amounted to RM72,000

(2022: RM49,000).

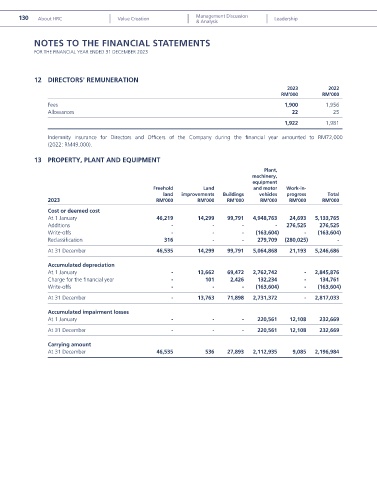

13 PROPERTY, PLANT AND EQUIPMENT

Plant,

machinery,

equipment

Freehold Land and motor Work-in-

land improvements Buildings vehicles progress Total

2023 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Cost or deemed cost

At 1 January 46,219 14,299 99,791 4,948,763 24,693 5,133,765

Additions - - - - 276,525 276,525

Write-offs - - - (163,604) - (163,604)

Reclassification 316 - - 279,709 (280,025) -

At 31 December 46,535 14,299 99,791 5,064,868 21,193 5,246,686

Accumulated depreciation

At 1 January - 13,662 69,472 2,762,742 - 2,845,876

Charge for the financial year - 101 2,426 132,234 - 134,761

Write-offs - - - (163,604) - (163,604)

At 31 December - 13,763 71,898 2,731,372 - 2,817,033

Accumulated impairment losses

At 1 January - - - 220,561 12,108 232,669

At 31 December - - - 220,561 12,108 232,669

Carrying amount

At 31 December 46,535 536 27,893 2,112,935 9,085 2,196,984