Page 134 - HRC_Annual_Report_2023

P. 134

132 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

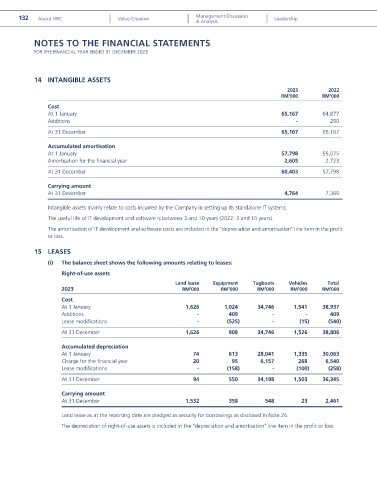

14 INTANGIBLE ASSETS

2023 2022

RM’000 RM’000

Cost

At 1 January 65,167 64,877

Additions - 290

At 31 December 65,167 65,167

Accumulated amortisation

At 1 January 57,798 55,075

Amortisation for the financial year 2,605 2,723

At 31 December 60,403 57,798

Carrying amount

At 31 December 4,764 7,369

Intangible assets mainly relate to costs incurred by the Company in setting up its standalone IT systems.

The useful life of IT development and software is between 3 and 10 years (2022: 3 and 10 years).

The amortisation of IT development and software costs are included in the “depreciation and amortisation” line item in the profit

or loss.

15 LEASES

(i) The balance sheet shows the following amounts relating to leases:

Right-of-use assets

Land lease Equipment Tugboats Vehicles Total

2023 RM’000 RM’000 RM’000 RM’000 RM’000

Cost

At 1 January 1,626 1,024 34,746 1,541 38,937

Additions - 409 - - 409

Lease modifications - (525) - (15) (540)

At 31 December 1,626 908 34,746 1,526 38,806

Accumulated depreciation

At 1 January 74 613 28,041 1,335 30,063

Charge for the financial year 20 95 6,157 268 6,540

Lease modifications - (158) - (100) (258)

At 31 December 94 550 34,198 1,503 36,345

Carrying amount

At 31 December 1,532 358 548 23 2,461

Land lease as at the reporting date are pledged as security for borrowings as disclosed in Note 26.

The depreciation of right-of-use assets is included in the “depreciation and amortisation” line item in the profit or loss.