Page 122 - HRC_Annual_Report_2023

P. 122

120 About HRC Value Creation Management Discussion Leadership

& Analysis

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

The Company is exposed to a variety of financial risks; market risk (including foreign currency exchange risk, interest rate risk,

commodity price risk and refining margin risk), credit risk, liquidity and cash flow risk and capital risk. The Company’s overall

financial risk management objective is to ensure the Company creates value for its shareholders. The Company focuses on

the unpredictability of financial markets and seeks to minimise potential adverse effects on the financial performance of the

Company. Financial risk management is carried out through risk reviews, assurance plans, internal control systems, insurance

programmes and adherence to the Company’s Treasury Policy and Procedures.

The Company may enter into foreign exchange forward contracts to manage its exposure to foreign currency risks in receivables

and payables. Straightforward derivative financial instruments are utilised by the Company to manage the exposure to foreign

currency exchange risk, commodity price risk, refining margin risk and interest rate risks. The Company does not enter into

derivative financial instruments that are speculative in nature.

Where all relevant criteria are met, hedge accounting is applied to remove the accounting mismatch between the hedging

instrument and the hedged item. This will effectively result in recognising interest expense at a fixed interest rate for the hedged

floating rate loans and locking the refining margin for the hedged forecast purchases and sales.

The Company’s accounting policy on its cash flow hedges is set out on Note 2.9(a).

For information about the methods and assumptions used in determining the fair value of derivatives refer to Note 5.

(a) Market risk

Market risk refers to the risk that changes in market prices, such as foreign exchange rates, interest rates and prices will

affect the Company’s financial position and cash flows.

(i) Foreign currency exchange risk

Foreign currency exchange risk is the risk that the fair value of future cash flows of a financial instrument will

fluctuate because of changes in foreign exchange rates.

The objective of the Company’s currency risk management policies is to allow the Company to effectively manage

exposures that may arise from operating and financing activities.

The Company may enter into foreign currency swaps and forward contracts to limit its exposure on foreign currency

receivables and payables and on cash flows generated from anticipated transactions denominated in foreign

currencies. These foreign currency receivables and payables do not qualify as “highly probable” forecast transactions

and hence do not satisfy the requirements for hedge accounting (economic hedges). The foreign currency

swaps and forward contracts are subject to the same risk management policies as all other derivative contracts.

They are accounted for as “held for trading” with gains or losses recognised in profit or loss.

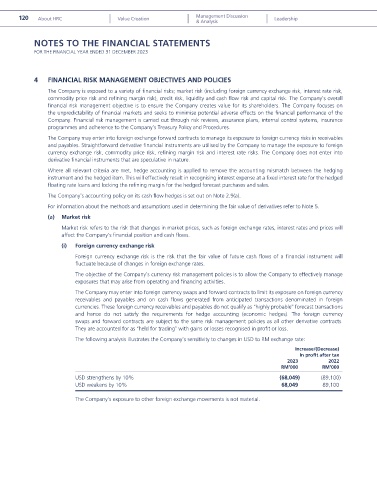

The following analysis illustrates the Company’s sensitivity to changes in USD to RM exchange rate:

Increase/(Decrease)

in profit after tax

2023 2022

RM’000 RM’000

USD strengthens by 10% (68,049) (89,100)

USD weakens by 10% 68,049 89,100

The Company’s exposure to other foreign exchange movements is not material.