Page 123 - HRC_Annual_Report_2023

P. 123

Financial Reports &

Governance HENGYUAN REFINING COMPANY BERHAD l ANNUAL REPORT 2023 121

Other Information

NOTES TO THE FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2023

4 FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

(a) Market risk (continued)

(ii) Interest rate risk

Cash flow interest rate risk is the risk that the future cash flows of a financial instrument will fluctuate because of

changes in market interest rates.

The Company finances its operations through a mixture of retained earnings and bank borrowings. The Company’s

interest rate risk arises from borrowings at variable rates and deposits with licensed banks and are managed in

compliance with the treasury policy of the Company.

The Company has an approved policy to hedge interest rate risk as part of the Company’s risk management policy.

Generally, the Company may enter into long-term borrowings at floating rates and swaps them into fixed rates,

if the need arises. The Company’s borrowings at variable rate is denominated in both USD and MYR.

Surplus funds are placed with licensed financial institutions to earn interest income based on prevailing market rates.

The Company manages its interest rate risks by placing such funds on short tenures of 12 months or less.

The interest rate profile of the Company’s significant interest-bearing financial instrument has been presented in

Note 26.

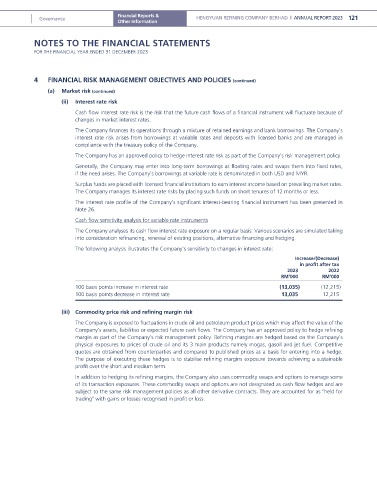

Cash flow sensitivity analysis for variable rate instruments

The Company analyses its cash flow interest rate exposure on a regular basis. Various scenarios are simulated taking

into consideration refinancing, renewal of existing positions, alternative financing and hedging.

The following analysis illustrates the Company’s sensitivity to changes in interest rate:

Increase/(Decrease)

in profit after tax

2023 2022

RM’000 RM’000

100 basis points increase in interest rate (13,035) (12,215)

100 basis points decrease in interest rate 13,035 12,215

(iii) Commodity price risk and refining margin risk

The Company is exposed to fluctuations in crude oil and petroleum product prices which may affect the value of the

Company’s assets, liabilities or expected future cash flows. The Company has an approved policy to hedge refining

margin as part of the Company’s risk management policy. Refining margins are hedged based on the Company’s

physical exposures to prices of crude oil and its 3 main products namely mogas, gasoil and jet fuel. Competitive

quotes are obtained from counterparties and compared to published prices as a basis for entering into a hedge.

The purpose of executing these hedges is to stabilise refining margins exposure towards achieving a sustainable

profit over the short and medium term.

In addition to hedging its refining margins, the Company also uses commodity swaps and options to manage some

of its transaction exposures. These commodity swaps and options are not designated as cash flow hedges and are

subject to the same risk management policies as all other derivative contracts. They are accounted for as “held for

trading” with gains or losses recognised in profit or loss.