Page 36 - HRC_Annual_Report_2023

P. 36

34 About HRC Value Creation Management Discussion Leadership

& Analysis

FY2023 STRATEGIC REVIEW

Strategic Initiative 3

Enhance employees’ learning and development in Therefore, we have taken steps to continuously invest

sustainability in employees’ training and development programmes in

the aspects of ESG as well to further build their expertise

Upskilling in sustainability enables our employees to

understand and implement more efficient technologies and related to environmental stewardship, social responsibility,

processes that will help reduce carbon footprint. Employees and ethical business practices. This contributes to

with sustainability skills are better prepared to navigate and employee transformation by fostering a workforce that is

contribute, as global awareness and regulations around sustainability focused.

environmental impact intensify, and the industry faces

increasing pressure to adopt sustainable practices.

2024 People & Leadership Priorities:

• Continue to implement People Programme initiatives for enhanced workforce management and employee engagement

• Nurturing and preparing talents for future leadership roles through the people development programme, supported by the

leadership development programme

• Launch an employer branding programme through career fairs and university visits to attract potential talents

• Implement wellness programmes to support the physical and mental well-being of our employees

For more details on our Human Resource initiatives, please refer

to pages 55 to 64 of our Sustainability Report 2023.

OPERATIONAL EXCELLENCE

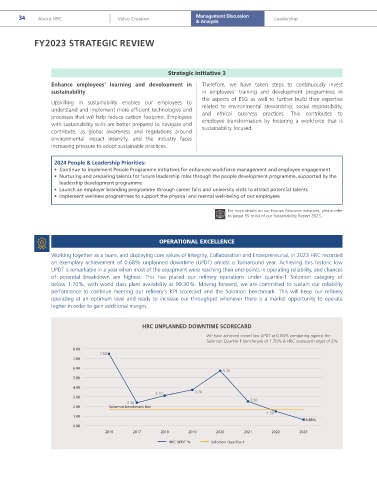

Working together as a team, and displaying core values of Integrity, Collaboration and Entrepreneurial, in 2023 HRC recorded

an exemplary achievement of 0.68% unplanned downtime (UPDT) amidst a Turnaround year. Achieving this historic low

UPDT is remarkable in a year when most of the equipment were reaching their end-points in operating reliability, and chances

of potential breakdown are highest. This has placed our refinery operations under quartile-1 Solomon category of

below 1.70%, with world class plant availability at 99.30%. Moving forward, we are committed to sustain our reliability

performance to continue meeting our refinery’s KPI scorecard and the Solomon benchmark. This will keep our refinery

operating at an optimum level and ready to increase our throughput whenever there is a market opportunity to operate

higher in order to gain additional margin.

HRC UNPLANNED DOWNTIME SCORECARD

We have achieved record low UPDT at 0.68% comparing against the

Solomon Quartile-1 benchmark of 1.70% & HRC scorecard target of 2%

8.00

7.50

7.00

6.00

5.70

5.00

4.00

3.10 3.70

3.00

2.50

2.30

2.00 Solomon benchmark line

1.50

1.00

0.68%

0.00

2016 2017 2018 2019 2020 2021 2022 2023

HRC UPDT % Solomon Quartile-1